Tax Revenue

A recent economic study shows the Louisiana International Terminal will create a sustainable source of tax revenue for the Parish. The project will help support existing businesses and draw new kinds of businesses to the area.

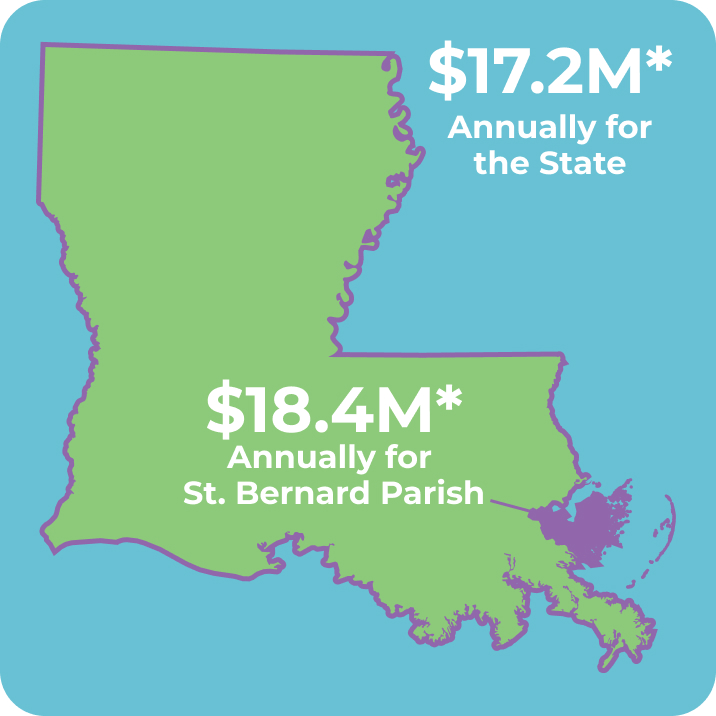

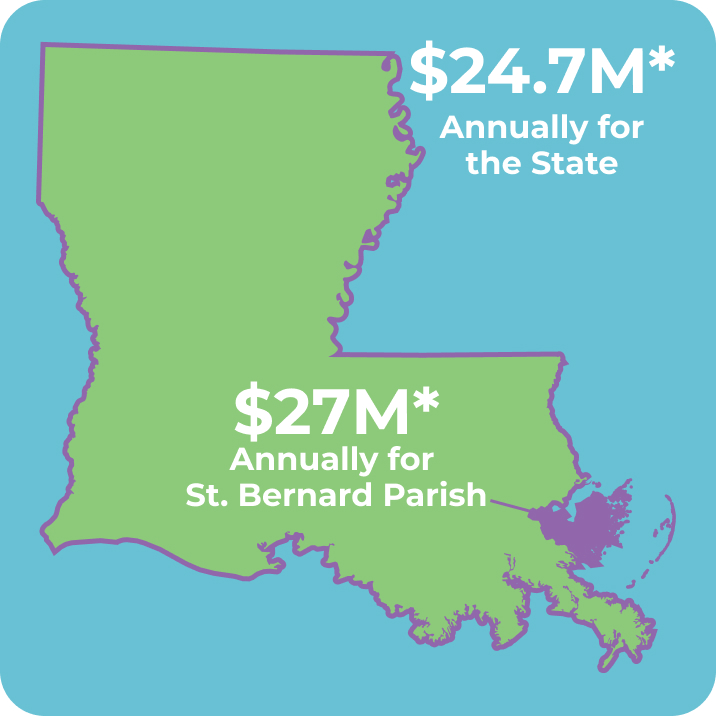

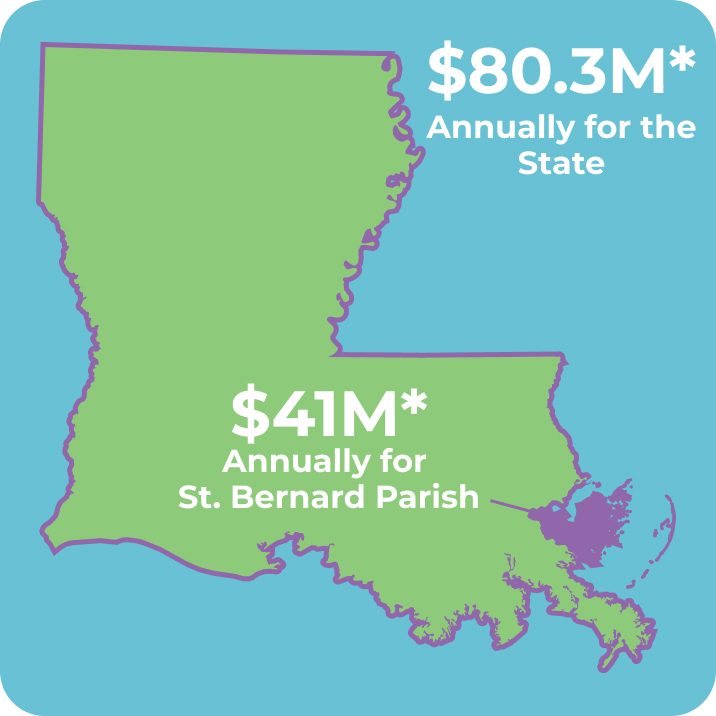

New Tax Revenue Over Time

$205 million lost in existing state taxes

If the proposed terminal is not built, Louisiana won't be able to handle the larger ships that are becoming more common. International shipping companies will take their business to competing ports in Houston and Mobile. Distributors and warehouses will follow. As a result, Louisiana could see existing tax revenue drop significantly in just 10 years (2033).

*Source: Lewis Terrell and Associates, No LIT Loss Summary. October 2022.

Who Pays Taxes?

As a subdivision of the state, the Port of New Orleans is exempt from property taxes. The private port operator and other companies owning property at the terminal are not.

Property Tax

The terminal operators will own improvements and equipment on the terminal, which are taxable. Private companies off property involved in trade related to the terminal will also pay property tax.

Sales Tax

Direct sales and use taxes will apply to the terminal operators' construction and equipment costs. Sales tax will also be collected on taxable goods and services both on and off the terminal.

Increased tax revenues will give St. Bernard and the state the ability to invest in:

Parks and

Recreation

Schools

Roads/Bridges/

Infrastructure

Public Safety

Drainage

Environmental

Projects